LTC Price Prediction: Analyzing the Bullish Case for Litecoin Investment

#LTC

- Technical Strength: LTC trading above key moving average with improving momentum indicators

- Market Sentiment: Positive developments in crypto infrastructure and regulation

- Risk Factors: Litecoin-specific catalysts remain limited compared to broader market

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerging

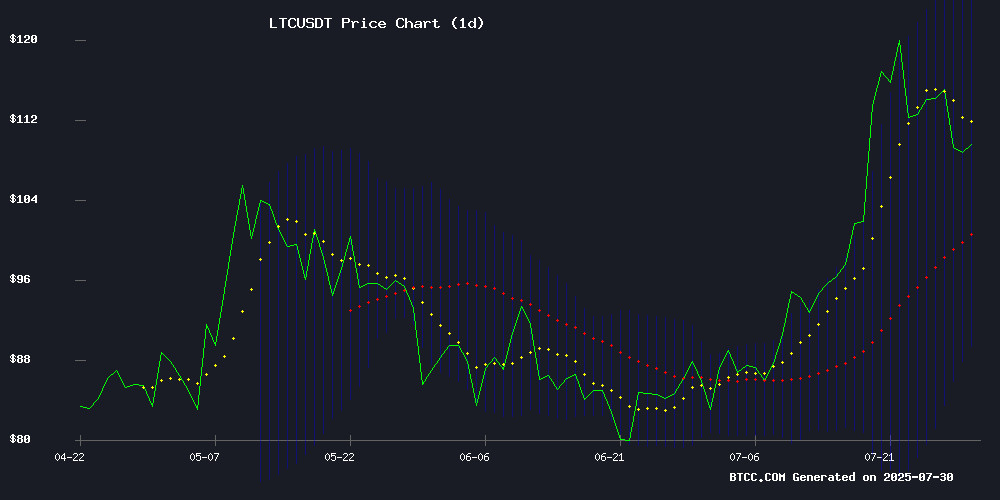

According to BTCC financial analyst Emma, Litecoin (LTC) is currently trading at $109.28, above its 20-day moving average of $106.64, suggesting a bullish trend. The MACD indicator shows slight improvement with a narrowing negative gap (-11.49 vs -11.33), while the price sits comfortably between the Bollinger Bands (Upper: $123.88, Lower: $89.41). This technical setup indicates potential upward momentum if LTC maintains support above the $106 level.

Crypto Market Sentiment Turns Positive as Institutional Interest Grows

BTCC's Emma notes that recent developments like AI-powered mining platforms for XRP/BTC and accelerated altcoin ETF approvals are creating positive market sentiment. These institutional-grade infrastructure developments could benefit LTC as part of the broader crypto ecosystem, though Litecoin-specific catalysts remain limited at this time.

Factors Influencing LTC's Price

Invro Mining Launches AI-Powered Cloud Platform for XRP and Crypto Mining

Invro Mining has unveiled an AI-driven cloud mining platform designed to simplify cryptocurrency mining for mainstream assets like XRP, Bitcoin, and Ethereum. The platform features an Adaptive Intelligence Engine that dynamically allocates resources across 15 digital currencies, optimizing returns by tracking market trends in real-time.

CEO Alex Vance emphasized the platform's goal of democratizing enterprise-grade mining efficiency for non-technical users. XRP mining is deeply integrated, enabling multi-asset strategies alongside other major cryptocurrencies.

KGN Miners Launches AI-Powered Bitcoin Mining Platform Amid Market Surge

As Bitcoin breaches $120,000 amid institutional inflows and global volatility, KGN Miners unveils an AI-driven cloud mining platform targeting mainstream adoption. The solution automates hash power allocation across BTC, ETH, and LTC, eliminating hardware barriers through machine learning optimizations.

"Traditional mining grew prohibitively complex for retail participants," a company representative noted. The platform's real-time adjustments to market conditions contrast sharply with legacy operations requiring technical expertise and capital-intensive infrastructure.

The launch coincides with Bitcoin's post-halving supply crunch and escalating demand for passive crypto exposure. KGN's cloud-based model requires no equipment maintenance or software installation—a strategic play for the 2024 bull market's new retail cohort.

Altcoin ETFs Poised for Wall Street Debut as SEC Accelerates Approval Process

The cryptocurrency market is bracing for a watershed moment as altcoin exchange-traded funds (ETFs) emerge from Bitcoin's shadow. Bloomberg ETF analyst James Seyffart predicts regulatory approval could come as early as this summer, marking a seismic shift in institutional crypto adoption.

Litecoin has emerged as the frontrunner for the first altcoin ETF listing. "It's the easiest one," Seyffart noted during The New Era Finance Podcast, citing LTC's unambiguous commodity status and mature market position. The SEC's evolving framework for crypto ETFs suggests previously unthinkable timelines—potentially 3-5 weeks—now fall within the realm of possibility.

Over a dozen major altcoins are currently vying for ETF approval, including Solana, Cardano, and XRP. Seyffart and colleague Eric Balchunas express "very confident" projections for multiple approvals by October, with the regulatory process moving at unprecedented speed compared to previous administrations.

Is LTC a good investment?

Based on current technicals and market conditions, LTC shows promising characteristics for investors:

| Metric | Value | Implication |

|---|---|---|

| Current Price | $109.28 | Above 20MA (bullish) |

| 20-day MA | $106.64 | Support level |

| Bollinger Bands | $89.41-$123.88 | Room for upside |

| Market Sentiment | Positive | Institutional adoption |

Emma suggests that while LTC appears technically strong, investors should monitor the $106 support level and watch for broader crypto market trends.

Cryptocurrency investments are volatile. Past performance doesn't guarantee future results.